Listen to This Article:

The culinary college search process is exciting. With so many different opportunities out there, you’ll be sure to find a program that lines up with your passions and career goals.

Financial planning for school, on the other hand, can be a bit overwhelming. It may be hard to know where to start. But don’t be discouraged—there are many resources available to you.

And, financial aid is not just for four-year colleges. To those who apply and qualify, there are many options available for two-year programs such as culinary school, too.

Types of Direct Federal Student Loans

There are two main types of direct loans (sometimes referred to as Stafford Loans or Direct Stafford Loans, the names they used to go by) available through the federal government’s student loan program: subsidized and unsubsidized.

Subsidized Loans

Subsidized loans are loans in which the U.S. Department of Education pays (or subsidizes) the interest while you are enrolled, at minimum half-time status, in an undergraduate program, and for the first six months after you leave school or during a period of deferment. You, the student loan borrower, are responsible for paying back the principal amount of the loan and any interest that accrues after the six month grace period — or six months after ceasing to maintain a half-time status as a student. Subsidized loans are available to students who demonstrate financial need.

Unsubsidized Loans

Students who are unable to demonstrate financial need may consider utilizing an unsubsidized loan. These loans are available to undergraduate and graduate students, and it is the responsibility of the student loan borrower to pay back the interest on unsubsidized loans, in addition to the principal amount.

Federal Direct Loans through the U.S. Department of Education, whether subsidized or unsubsidized, offer several key benefits for students, including fixed interest rates and more flexible payment options. Plus, you don’t need a credit check or a cosigner to obtain most federal student loans. The U.S. Department of Education lists the current year’s interest rates.

How Do I Know Which Type of Loan I am Eligible For?

Basic eligibility requirements for federal student aid are outlined on the U.S. Department of Education’s website. To find out the specific types of loans that you are eligible for based on financial need, you’ll have to fill out the FAFSA—a Free Application for Federal Student Aid. Follow this link to get started by creating an account called the FSAID.

The Free Application for Federal Student Aid (FAFSA) could save you money

The FAFSA application may seem intimidating, but when you break it down, it’s not as scary as it seems. Filling out the FAFSA is completely free and doesn’t require any commitment to attend school or to borrow money. You have nothing to lose by filling it out!

Is FAFSA on Hold?

In January of 2025, changes to federal grants and loans sparked some confusion amongst student loan and grant recipients. However, the Office of Management and Budget (OMB) has clarified that federal student aid funds (including Subsidized and Unsubsidized Direct Loans) are not impacted by these changes.

How Much Can I Borrow?

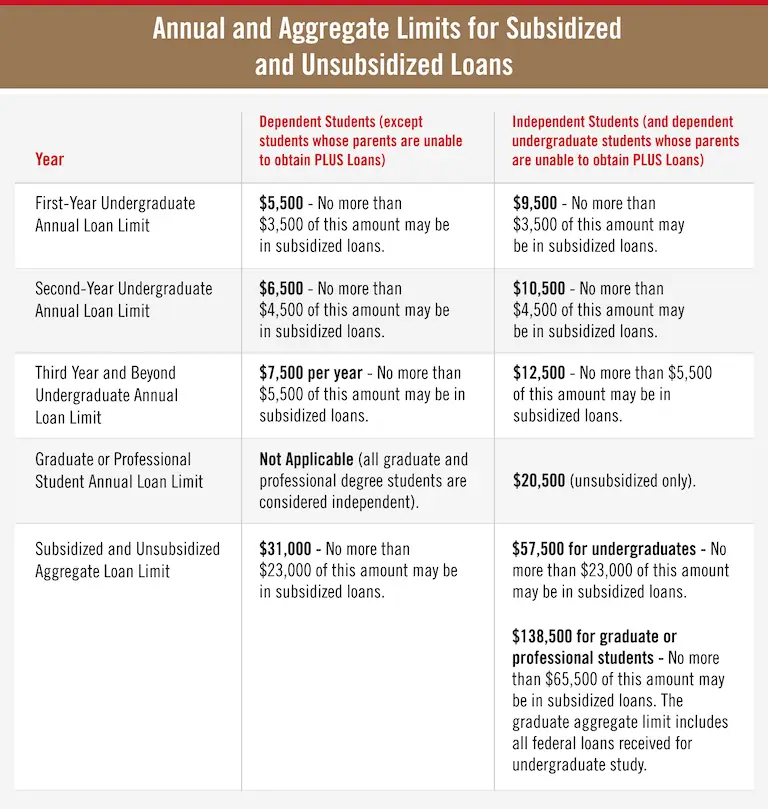

How much you can borrow through the federal student aid program depends on the type of loan. With direct student loans, the maximum amount you can borrow as an undergraduate student is $12,500 per year, and only up to $5,500 of that amount may be subsidized. However, the maximum amount may be lower based on factors such as what year you are in school and your dependency status. The U.S. Department of Education outlines in detail the annual and aggregate limits for subsidized and unsubsidized loans.

The Federal Student Aid website provides detailed information on direct student loan limits. Source: U.S. Department of Education.

You can choose to apply for additional loans to cover the remainder of your culinary college’s tuition or a portion of it. That amount will also depend on the type of loan. For example, the maximum amount that your parent(s) can borrow on your behalf through a PLUS loan is determined by the cost of attendance, minus the amount of financial aid you’re already receiving through other loans, grants, and scholarships.

Other Types of Loans Available

Federal PLUS Loans

Direct PLUS loans (Parent Loan for Undergraduate Students) are another Federal Direct loan option. While these are still considered a direct loan, they differ from the subsidized and unsubsidized student loans described above because one or both parents of the student take out this type of loan to help finance their child’s education, rather than the students themselves.

PLUS loans have a fixed interest rate and are not subsidized. They also require a credit check, and the applicant must not have an adverse credit history to receive this type of loan.

Direct PLUS loans or private loans often require proof of creditworthiness.

Private Loans

Private loans are any loans in which another entity other than the federal government is the lender. This usually involves taking out a loan from a bank or credit union. Private loans typically have much higher interest rates than federal loans. They also don’t have the same protections that federal loans do, such as the option to defer payment until after you are done with culinary school or the ability to consolidate your loans.

Recap: Four Types of Student Loans

Federal Student Loans

Direct loans in which the U.S. Department of Education is your lender. These loans are categorized as:

- Subsidized: The student loan borrower repays principal amount, and the government covers accrued interest while the student is enrolled (at least half-time) and for six months following graduation. These loans are available based on student financial need.

- Unsubsidized: The student loan borrower is responsible for repaying the principal amount plus any accrued interest. Unsubsidized federal student loans are available regardless of financial need.

- Federal PLUS Loans: The parent(s) of a student is responsible for repaying the principal amount plus any accrued interest. Unlike subsidized or unsubsidized loans, PLUS Loans may require a credit check or endorser (similar to a cosigner).

Pros/Cons of Direct Loans:

- Pros: Fixed interest rates, flexible repayment options, and need-based options.

- Cons: Lower borrowing limits.

Private Student Loans

These loans are given by a lender other than the federal government, such as a bank or credit union.

Pros/Cons of Private Loans:

- Pros: No specific application deadlines, higher borrowing limits, and high credit scores may result in more favorable terms.

- Cons: Private loans are based on creditworthiness and they may require a cosigner, have higher or variable interest rates, and do not allow flexible repayment options (for example, you may need to begin repaying your private loan while attending school). Furthermore, they may have prepayment penalties and they typically aren’t eligible for loan forgiveness.

Here’s a handy chart that can help you differentiate the terms of Direct Student Loans, Direct Parent Loans, and Private Student Loans.

*Information may not reflect every student’s experience. Results and outcomes may be based on several factors, such as geographical region or previous experience.

There Are Many Resources That Can Help Finance Your Education

Don’t let money be the reason holding you back from a culinary education. In addition to loans, there are grants and scholarship opportunities available that may help finance your education.

If you’re interested in attending culinary school, contact us to speak to a financial aid advisor at Auguste Escoffier School of Culinary Arts who can help you understand the options available to you.

OTHER ARTICLES ABOUT CULINARY SCHOOL FINANCIAL PLANNING THAT YOU MAY BE INTERESTED IN:

- How Much Does Culinary School Cost and How Can You Pay For it?

- How Long Does it Take to Pay Back Student Loan Debt… and is it Worth it?

- FAFSA® for Culinary School: The Essential Guide

*Information may not reflect every student’s experience. Results and outcomes may be based on several factors, such as geographical region or previous experience.